The Future of Streaming Wars and the Battle for Exclusivity

For more than a decade, the streaming industry has transformed how audiences consume entertainment. What began as a handful of platforms offering on-demand content has now evolved into a fiercely competitive battleground where companies fight for every subscription dollar. The days of effortless dominance by Netflix are over. With rivals like Disney+, HBO Max, and Amazon Prime Video investing billions into content, the streaming wars have entered a new phase—one defined by exclusivity.

Why Exclusivity Matters More Than Ever

Exclusivity has become the holy grail of streaming success. In an age where viewers are overwhelmed by choice, platforms must offer something unique to keep audiences engaged and, more importantly, paying.

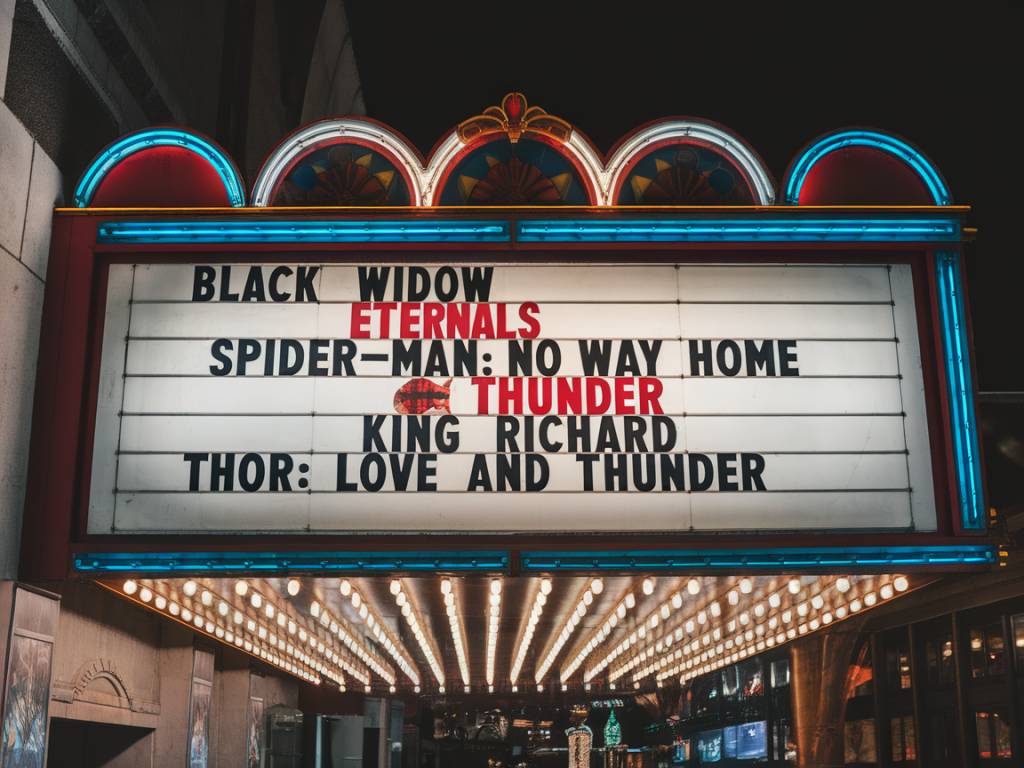

Take Disney+, for example. The company’s aggressive move to pull its content from Netflix and consolidate it under its own platform instantly made Disney+ a dominant force. As a result, must-watch franchises like Star Wars and the Marvel Cinematic Universe became unavailable anywhere else. HBO Max followed a similar strategy, leveraging its ownership of Game of Thrones, DC films, and classic Warner Bros. properties to build an attractive library for loyal subscribers.

Exclusive content isn’t merely about offering unique shows—it’s about creating a brand identity. Apple TV+ has used exclusivity to carve out a niche with carefully curated, high-production originals like Ted Lasso and Severance. Amazon, too, made a bold gamble on The Lord of the Rings: The Rings of Power, investing nearly $1 billion in a show meant to rival HBO’s fantasy dominance.

The Fragmentation Problem: How Many Subscriptions Are Too Many?

While exclusivity helps media conglomerates lock in audiences, it’s also contributing to a growing frustration among consumers. Streaming was once heralded as the antidote to expensive cable packages—a way to access top-tier entertainment on demand, without restrictive contracts. But now, as content spreads across a fragmented landscape, audiences face a dilemma: How many streaming services are worth the cost?

A decade ago, subscribing to Netflix alone was often enough to stay entertained. Today, a viewer wanting access to popular content must potentially subscribe to multiple platforms:

- Netflix: Original hits like Stranger Things and The Witcher

- Disney+: Marvel, Star Wars, Pixar, and classic Disney films

- HBO Max: Prestige TV hits including House of the Dragon and acclaimed Warner Bros. movies

- Amazon Prime Video: High-budget originals like The Boys and The Rings of Power

- Apple TV+: Critically acclaimed exclusives like Severance and Foundation

The industry’s strategy to divide and conquer consumers comes at a cost—subscription fatigue. A growing number of users are finding it unrealistic to keep up with multiple streaming bills, leading to a rise in account sharing, rotation (subscribing for a month, binge-watching, then canceling), and growing calls for consolidation.

Bundles and Consolidation: The Next Phase?

With consumers voicing frustration over the increasing number of streaming platforms, companies are already exploring bundling options. Disney, for example, offers a package that includes Disney+, Hulu, and ESPN+—a response to the growing demand for simpler, more affordable solutions. Amazon Prime, which includes access to Prime Video alongside free shipping perks, is another example of how companies are creating value beyond just streaming.

Industry analysts predict that we may eventually see a return to “streaming bundles,” a modern version of the cable model where multiple services come together under one package. Partnerships like the recent Netflix and Microsoft ad-supported subscription tier or potential alliances between smaller platforms could drive the market toward greater consolidation.

The Rise of Ad-Supported Models

One of the most notable trends in the streaming wars is the pivot toward advertising-supported tiers. Initially, streaming platforms prided themselves on being ad-free, emphasizing consumer convenience. However, as subscriber growth shows signs of slowing, companies are looking for new ways to maximize revenue.

Netflix, which resisted ads for years, eventually launched an ad-supported tier in 2022, followed by similar moves from Disney+ and HBO Max. The shift suggests that even major players recognize that not all subscribers are willing to pay premium prices. Instead, offering a lower-cost version supplemented by ads allows them to capture a broader audience while keeping their subscriber base engaged.

The Power Struggle Over Live Sports and Events

Beyond movies and TV shows, streaming services are entering a new battlefield: live sports and exclusive events. Amazon has secured exclusive rights to Thursday Night Football, Apple has invested heavily in live baseball and soccer deals, and YouTube has acquired NFL Sunday Ticket rights. Sports streaming could be the next major differentiator, as fans increasingly turn to online platforms instead of traditional cable networks.

Netflix, which has traditionally stayed away from live programming, is also rumored to be considering entering the space. If this trend continues, we could witness an even greater shake-up, with streaming platforms positioning themselves as the primary destination for not just on-demand entertainment, but also real-time experiences.

The Future of Streaming: Where Do We Go From Here?

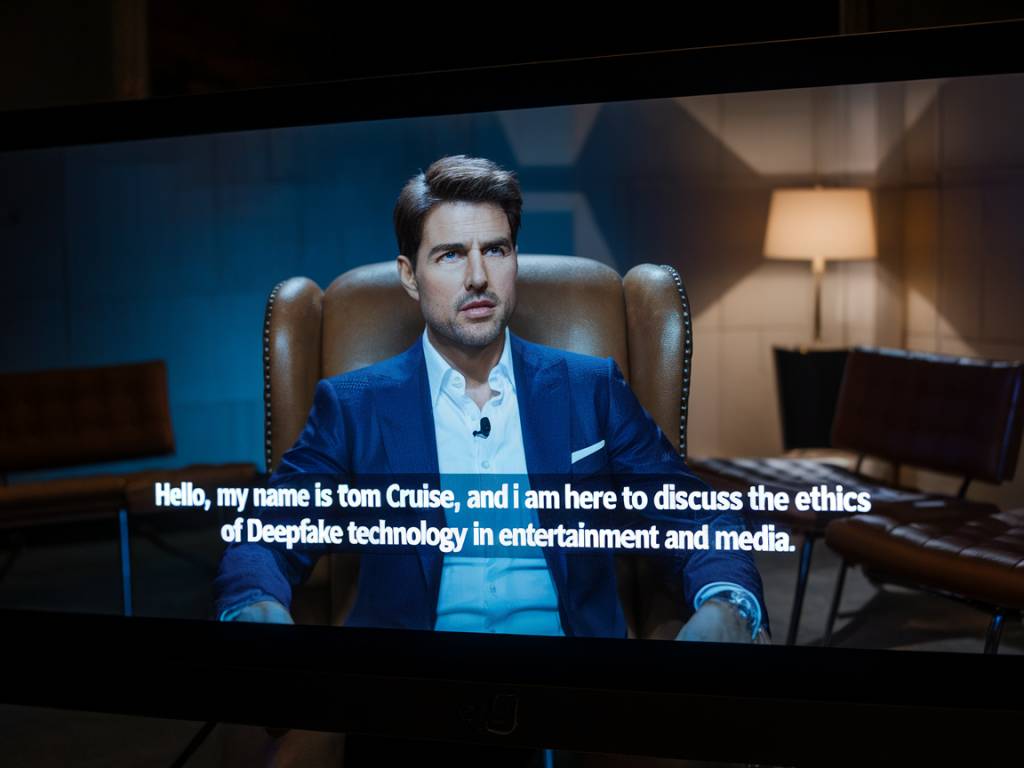

The battle for streaming supremacy is far from over, but one thing is clear: competition has fundamentally changed how the industry operates. As exclusivity wars intensify, streaming giants will continue fighting for dominant IPs, audience retention, and innovative content strategies.

However, as consumers demand affordability, convenience, and fewer subscription hassles, consolidation, bundling, and ad-supported models are likely to become the new normal. Whether the streaming wars will escalate further or find a sustainable balance remains to be seen—but one thing is certain: the industry will continue evolving, and audiences will have more choices than ever before.

So, which streaming service will emerge as the ultimate winner? Perhaps, in the end, the real victor will be the consumers who find new ways to navigate this ever-shifting digital landscape.